Investment and misallocation in infrastructure networks: The case of U.S. natural gas pipelines

(with Paul Schrimpf)

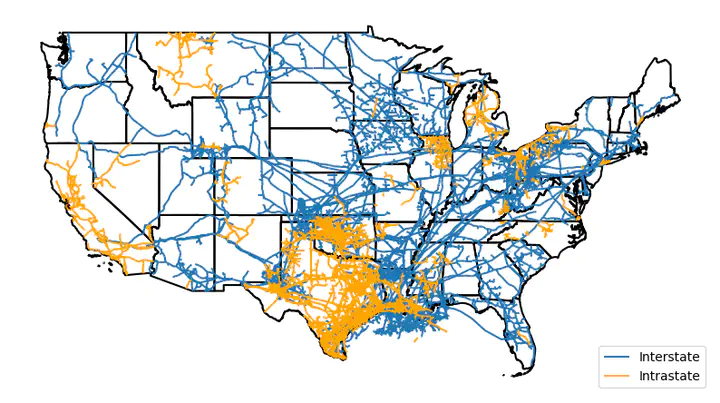

- This paper investigates regulatory distortion in the incentives for firms to invest in expanding transmission capacity in the United States natural gas pipeline network. Transmission rates for interstate gas pipelines are tightly controlled by federal regulators, who set them so that firms earn a fixed rate of return on capital under projected demand and cost conditions. This rate of return regulation removes the incentive of pipeline operators to exercise local market power by withholding capacity; however, it also distorts firms' incentives to invest in expanding network capacity. Misallocated capital in a transmission network can lead to inefficiencies and congestion. To ensure that new capital will be desirable, the regulator subjects new capital investment to a stringent approval process. Leveraging a detailed dataset of pipeline regulatory filings, we estimate a dynamic model of the firms' investment incentives using a debiased nonparametric machine learning approach. We then construct and estimate a structural measure of the marginal social value of capital that is based on a dynamic model of optimal network investment by a social planner. This measure ties the social value of pipeline capacity to differences in prices across state borders that exceed the marginal cost of transmission, indicating excess demand. We find that in most areas, the incentives of firms to invest in the pipeline network under fixed rates of return exceed the social value of capital. This suggests that some costly approval process surrounding pipeline investment is indeed necessary to realign firms' incentives to expand the network. While overall the implied investment costs have been close to optimal, at a disaggregated level we find evidence of some systematic deviations from the optimal policy both spatially and intertemporally. We suggest that a welfare-improving reallocation of regulatory costs would be one that streamlines investment approval in the northeast but increases regulatory stringency in the southeast and parts of the west.