Working papers

Show/Hide Abstract

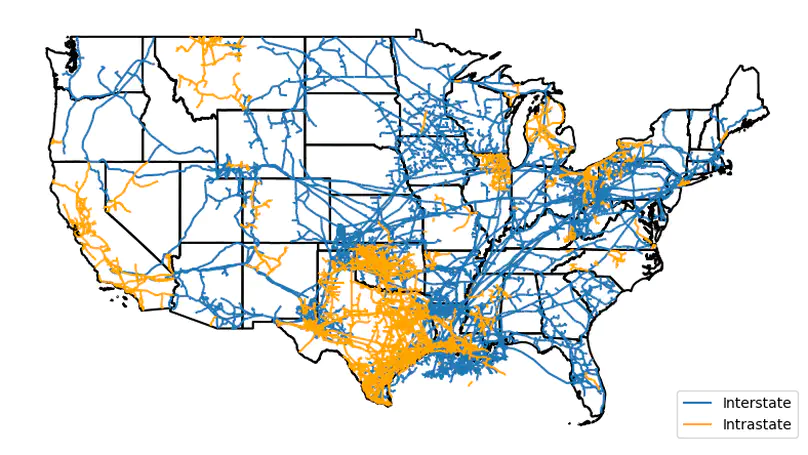

- This paper investigates regulatory distortion in the incentives to invest in transmission capacity in the United States natural gas pipeline network. We are motivated by the fact that trade of gas between states should temper regional price variation. However, price differences between locations frequently exceed the marginal cost of transmission, indicating that capacity constraints are binding. Gas pipelines are tightly regulated through both rate-of-return for pricing and a costly approval process, both of which could distort the firms’ investment incentives. When combined, the two sides of the regulatory structure could be used in tandem to design incentives that promote efficient network growth. To understand how well the policy aligns incentives with social value, we develop a structural model of a pipeline firm’s dynamic investment problem and estimate it nonparametrically using debiased machine learning. We then construct a measure of the social value of pipeline capital, based on a social planner model that ties the value of capacity expansion to regional price gaps. In most areas, the incentives of firms to invest under fixed rates of return exceed the social value of capital, highlighting the importance of costly approvals as a secondary tool to control investments. Even for a range of discount factors that rationalize the observed policy on average, there are systematic deviations from the optimal policy both spatially and intertemporally. We suggest a welfare improving reallocation of regulatory costs that would streamline the approval process in certain parts of the northeast, but shift focus toward the southeast and parts of the mountain west.

Show/Hide Abstract

- We examine behavior in an experimental collaboration game that incorporates endogenous network formation. The environment is modeled as a generalization of the voluntary contributions mechanism. By varying the information structure in a controlled laboratory experiment, we examine the underlying mechanisms of reciprocity that generate emergent patterns in linking and contribution decisions. Providing players more detailed information about the sharing behavior of others drastically increases efficiency, and positively affects a number of other key outcomes. To understand the driving causes of these changes in behavior we develop and estimate a structural model for actions and small network panels and identify how social preferences affect behavior. We find that the treatment reduces altruism but stimulates reciprocity, helping players coordinate to reach mutually beneficial outcomes. In a set of counterfactual simulations, we show that increasing trust in the community would encourage higher average contributions at the cost of mildly increased free-riding. Increasing overall reciprocity greatly increases collaborative behavior when there is limited information but can backfire in the treatment, suggesting that negative reciprocity and punishment can reduce efficiency. The largest returns would come from an intervention that drives players away from negative and toward positive reciprocity.

Publications

(2023).

Reputation and market structure in experimental platforms.

In Journal of Economic Behavior & Organization. Vol. 205, pp. 528-559. Elsevier.

(2022).

Input design for the optimal control of networked moments.

In Proceedings of the 61st IEEE Conference on Decision and Control (CDC). pp. 5894-5901. IEEE.

(2022).

The robustness of lemons in experimental markets.

In Research in Experimental Economics. Vol. 21, pp. 201-216. Emerald.

(2021).

Network controllability metrics for corruption research.

In Granados, O.M., Nicolás-Carlock, J.R. (eds) Corruption Networks. Understanding Complex Systems. pp. 29-50. Springer.

(2020).

Political corruption and the congestion of controllability in social networks.

In Applied Network Science. Vol 5, pp. 23. Springer.

Works in Progress

Barriers to entry and dynamic community structure in digital platforms

Coarse targeting in social networks

Viral demand and post-promotion behavior in platforms with network effects

Direct reputation and timing of quality decisions in the lemons market